Family Office Services

A family office framework helps you curate, coordinate and manage a team of your family’s trusted advisors to help your family develop and carry out long-term strategies for your family wealth.

We elevate our fiduciary wealth management services and provide you with additional knowledge, executive leadership and administrative support resources to help you develop, integrate and manage your team of wealth advisory professionals. Our family office framework also helps provide generational wealth management continuity.

IT’S JUST PART OF WHAT WE DO.

Fiduciary Wealth Management

Scottsdale | Phoenix

Scottsdale | Phoenix

CONSIDER EVERYTHING

Family Office Services

A family office framework helps you curate, coordinate and manage a team of your family’s trusted advisors to help your family develop and carry out long-term strategies for your family wealth.

We elevate our fiduciary wealth management services and provide you with additional knowledge, executive leadership and administrative support resources to help you develop, integrate and manage your team of wealth advisory professionals. Our family office framework also helps provide generational wealth management continuity.

IT’S JUST PART OF WHAT WE DO.

Fiduciary Wealth Management

Scottsdale | Phoenix

Scottsdale | Phoenix

Create value for you by developing the a wealth management plan to preserve, protect, grow, and transfer your wealth and implementing the disciplined investment and wealth management strategies to support your plan.

Create visual and operational lines of sight.

We help develop and maintain sustainable, cost-effective core family office services.

Family Office Services |

How we create value for you.

How we create value for you.

Circle 1 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Circle 2 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Circle 3 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Circle 6 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Circle 9 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

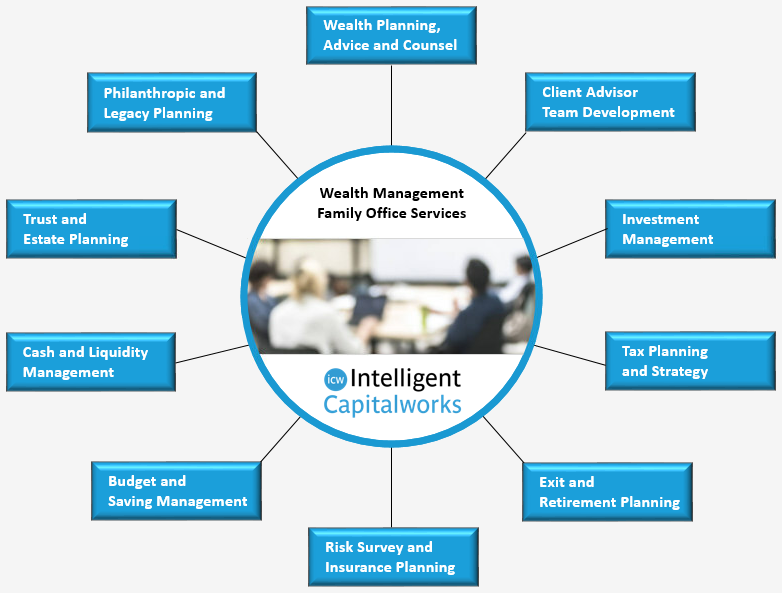

Services

We elevate our fiduciary wealth management services with additional knowledge, executive leadership and administrative support resources for these core wealth management functions.

Circle 10 dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Family Office Mindset |

How we create value for you.

How we create value for you.

| Family Office Mindset

| Family Office Mindset

How we create value for you.

Thought Leadership

Strategic Visualization

Pragmatic Structure

Applied Learning

NextGen Development

Implementation Support

Family Office Goals |

How we create value for you.

How we create value for you.

| Family Office Goals

| Family Office Goals

How we create value for you.

Broaden Scope

We help you develop, expand, protect and manage the more personal and consequential dimensions of family and individual wealth.

Cultivate Significance

Address Impact

We help you address the various implications, effects and collateral demands of generational wealth to support and contribute to your family’s sense of well-being.

Expand Capability

We provide you with additional knowledge, executive leadership and administrative support to curate, integrate and manage your team of advisors.

Create Continuity

We help provide generational wealth management continuity and help mitigate the loss of institutional learning and memory about your family.

Reduce Costs

We provide you with an operational business platform to help you manage your core wealth structure at a fraction of dedicated family office costs.

Family Office Profile |

How we create value for you.

How we create value for you.

| Family Office Profile

| Family Office Profile

How we create value for you.

Professional Team

We provide a professional wealth management team with the education, training and experience to fill the core roles of a family office. We provide a chief investment officer, chief client wealth officer, chief compliance officer, chief client administrative officer, estate planner and philanthropic advisor.

Flexible Structure

We provide a hybrid family office framework that combines the core integrated wealth management services embedded in our firm’s servicescape with outsourced partners as needed to bring the additional services and resources you desire to help meet your family’s unique needs.

Adoptable and Adaptable

For families and individuals with $25 million or more of investable net worth, we help you adopt, adapt and implement a family office mindset and framework to help you address and manage the additional responsibilities and complexities that come with greater financial success.

CONSIDER EVERYTHING

Financial Advice and Guidance

01

Planning and managing personal wealth can be a complex business endeavor requiring professionals with both depth and breadth of field, dedicated resources and specialized tools. We serve as a dedicated advisor to help meet our clients’ wealth management needs in deeper, more focused and more helpful relationships. We are prepared to be your first call.

It's just part of what we do.

CONSIDER EVERYTHING

Financial Planning for Success

02

Plans describe your achievements in advance. Protecting, conserving, growing and transferring your wealth all require studies, scenario analyses and financial plans to increase the probabilities of your success. Whether you’re building or selling your business, experiencing success in your career, planning to retire or have already retired, we help you plan to create greater success.

It's just part of what we do.

CONSIDER EVERYTHING

Financial Risk Management

03

Risk and insurance touches every aspect of personal and business life. Risks to your life, health, property, livelihood and ability to work, profession, personal data . . . life is full of risks. Insurance helps keep you whole when bad things occasionally happen. We don’t sell insurance. We help develop, organize and manage your risk matrix and protection strategies.

It's just part of what we do.

CONSIDER EVERYTHING

Cash Flow Management

04

You will either need to save from the money you earn, the money you inherit, or possibly both, and invest to replace your earned income. Some of us will be fortunate enough to inherit, but most of us will need to save from the money we earn and invest it for the day when we wish to stop working or are no longer able to work. We help you track and manage your expenses and achieve your saving goals.

It's just part of what we do.

CONSIDER EVERYTHING

Cash and Liquidity Management

05

Active cash management and credit facilities support stable and healthy cash flow management. We help you maintain control over lumpy or mismatched timing of cash flows, unexpected cash flow reductions or losses, or the headwinds of unexpected or increased expenditures. We help you manage cash and liquidity to meet your financial obligations and improve your financial efficiency.

It's just part of what we do.

CONSIDER EVERYTHING

Tax Planning and Strategy

06

The number of tax regimes we are all faced with is mind-boggling. We help address the computational complexity of multiple layers of taxation. We help you consider how to best structure the investments you make and your exit strategy before you commit capital. We help you improve your asset location strategies to minimize your tax costs and improve your overall tax efficiency and effectiveness.

It's just part of what we do.

CONSIDER EVERYTHING

Investment Management

07

If you don't get this right, nothing else matters. Precious few plans will succeed without saving and long-term, after-tax compounding of your investment returns. We help position your investments and accounts to benefit from after-tax, risk-managed, long-term wealth compounding. We tailor and manage separate accounts of individual securities diversified for each client.

It's just part of what we do.

CONSIDER EVERYTHING

Wealth Management Team

08

No one feels fully prepared when stepping into the endeavor of becoming the CEO of their wealth for the first time. It is a workspace of multiple disciplines in multiple dimensions. We are C-Suite professionals purpose-focused to help you gain the benefits from working with a professional inter-disciplinary wealth management team. We are educated, trained and experienced for this work.

It's just part of what we do.

CONSIDER EVERYTHING

Trust and Estate Planning

09

Planning for the protection of you and your family in all phases of your life and the successful transfer of your estate helps contribute to the legacy of your life’s work. Without a plan, you expose you and your family to unnecessary risks and forfeit protections and opportunities for more desirable outcomes. We help you express and protect your wishes and protect you and your family from less desirable outcomes.

It's just part of what we do.

CONSIDER EVERYTHING

Philanthropic and Legacy Planning

10

Philanthropic and legacy planning helps enable you to expand your estate planning effort with a mosaic of values, meaning, guidance, purpose and responsibility for your posterity and matters that are of lasting importance to you. We help you plan and express your philanthropic intent while minimizing administrative complexity. We help you manage your philanthropic investments and commitments.

It's just part of what we do.

CONSIDER EVERYTHING

Financial Advice and Guidance

01

Planning and managing personal wealth can be a complex business endeavor requiring professionals with both depth and breadth of field, dedicated resources and specialized tools. We serve as a dedicated advisor to help meet our clients’ wealth management needs in deeper, more focused and more helpful relationships. We are prepared to be your first call.

Financial Planning

for Success

02

Plans describe your achievements in advance. Protecting, conserving, growing and transferring your wealth all require studies, scenario analyses and financial plans to increase the probabilities of your success. Whether you’re building or selling your business, experiencing success in your career, planning to retire or have already retired, we help you plan to create greater success.

Financial Risk

Management

03

Risk and insurance touches every aspect of personal and business life. Risks to your life, health, property, livelihood and ability to work, profession, personal data . . . life is full of risks. Insurance helps keep you whole when bad things occasionally happen. We don’t sell insurance. We help develop, organize and manage your risk matrix and protection strategies.

Cash Flow

Management

04

You will either need to save from the money you earn, the money you inherit, or possibly both, and invest to replace your earned income. Some of us will be fortunate enough to inherit, but most of us will need to save from the money we earn and invest it for the day when we wish to stop working or are no longer able to work. We help you track and manage your expenses and achieve your saving goals.

Cash and Liquidity

Management

05

Active cash management and credit facilities support stable and healthy cash flow management. We help you maintain control over lumpy or mismatched timing of cash flows, unexpected cash flow reductions or losses, or the headwinds of unexpected or increased expenditures. We help you manage cash and liquidity to meet your financial obligations and improve your financial efficiency.

Tax Planning

and Strategy

06

The number of tax regimes we are all faced with is mind-boggling. We help address the computational complexity of multiple layers of taxation. We help you consider how to best structure the investments you make and your exit strategy before you commit capital. We help you improve your asset location strategies to minimize your tax costs and improve your overall tax efficiency and effectiveness.

Investment

Management

07

If you don't get this right, nothing else matters. Precious few plans will succeed without saving and long-term, after-tax compounding of your investment returns. We help position your investments and accounts to benefit from after-tax, risk-managed, long-term wealth compounding. We tailor and manage separate accounts of individual securities diversified for each client.

Wealth Management Team

08

No one feels fully prepared when stepping into the endeavor of becoming the CEO of their wealth for the first time. It is a workspace of multiple disciplines in multiple dimensions. We are C-Suite professionals purpose-focused to help you gain the benefits from working with a professional inter-disciplinary wealth management team. We are educated, trained and experienced for this work.

Trust and Estate

Planning

09

Planning for the protection of you and your family in all phases of your life and the successful transfer of your estate helps contribute to the legacy of your life’s work. Without a plan, you expose you and your family to unnecessary risks and forfeit protections and opportunities for more desirable outcomes. We help you express and protect your wishes and protect you and your family from less desirable outcomes.

Philanthropic and

Legacy Planning

10

Philanthropic and legacy planning helps enable you to expand your estate planning effort with a mosaic of values, meaning, guidance, purpose and responsibility for your posterity and matters that are of lasting importance to you. We help you plan and express your philanthropic intent while minimizing administrative complexity. We help you manage your philanthropic investments and commitments.

It's just part of what we do.

INTER-DISCIPLINARY TEAM

How We Do It

We position you as the CEO for your capital.

It’s your capital, so we position you as the highest-ranking member of your wealth management team, responsible for setting the agenda and delegating responsibilities to C-Suite professionals.

The best CEOs recruit and hire proven, accomplished C-Suite professionals.

Our C-Suite professionals join your team.

We are professionals whose titles begin with C, meaning the “chiefs” who get things done.

This is the group of people with the most important roles to help you as CEO.

We have decades of deep experience advising wealthy families with complex financial needs.

Together, we focus on your desired results.

We help you get your capital working intelligently for you.